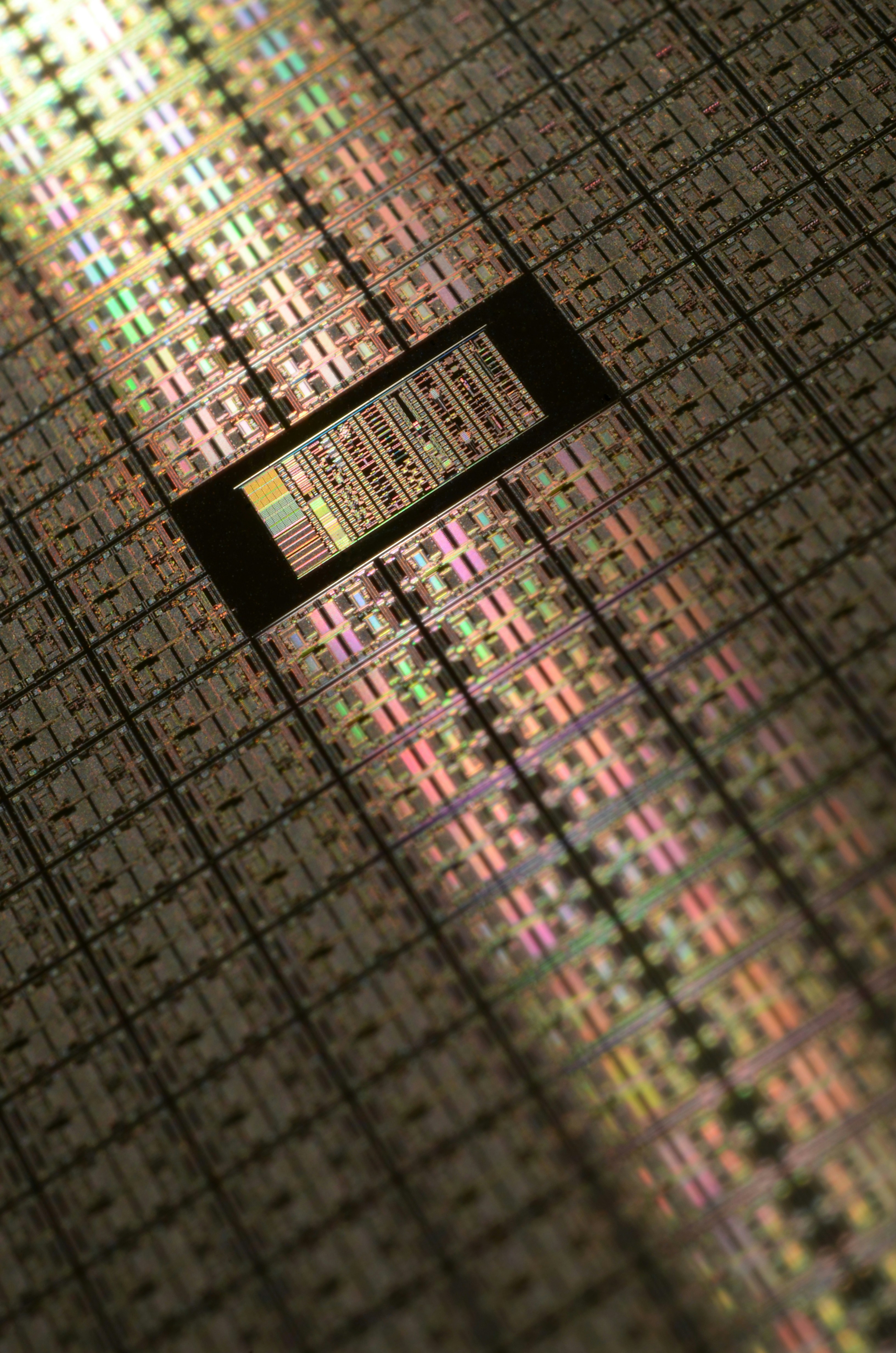

Intel Corporation (INTC) is a leading global technology company with roots extending back to 1968. Founded by Robert Noyce and Gordon Moore, Intel’s innovative spirit and commitment to excellence have positioned it prominently within the semiconductor industry. The company is best known for its microprocessors, central to the functioning of personal computers and servers around the world. Over the decades, Intel has diversified its product offerings, gradually entering various markets, including data center solutions, artificial intelligence, and Internet of Things (IoT) devices. These expansions have allowed the company to maintain a firm footprint across multiple sectors of technology.

In the realm of semiconductors, Intel has long been associated with technological advancements and superior performance. The introduction of the x86 architecture revolutionized computing, leading to widespread adoption in personal computers and providing the groundwork for modern computing. However, in recent years, Intel has faced stiff competition, particularly from companies like Nvidia and AMD. Nvidia’s rise in the graphics processing unit (GPU) market and AMD’s resurgence in CPU technology have significantly altered the competitive landscape. This evolution poses challenges for Intel, as the company strives to regain its leadership position amidst innovative competitors.

Despite these challenges, Intel remains a formidable player in the semiconductor market. The company’s investments in research and development have led to breakthroughs in manufacturing processes and technology, ensuring it stays relevant in an ever-changing industry. As the demand for advanced computing solutions grows, particularly with the increased reliance on cloud computing and AI, Intel’s market position is critical. The relative strength of its brand, distribution channels, and established relationships with key customers will play a crucial role in its ability to navigate the competitive landscape efficiently.

Understanding INTC Stock Performance

The performance of Intel (INTC) stock over recent years has showcased a complex landscape of trends and fluctuations, reflective of both internal dynamics and external market conditions. Historically, INTC stock has seen significant movement, influenced by various factors including quarterly earnings reports, shifts in consumer demand, and competitive pressures within the semiconductor industry. As one of the leading manufacturers of semiconductor products, Intel’s stock price has been subject to periodic rises and declines that demonstrate investor sentiment and broader economic trends.

In the past few years, Intel has faced considerable challenges that impacted its stock performance. For instance, competition from rivals such as AMD and NVIDIA has intensified, particularly in high-performance computing and data center markets. This competitive landscape has led to fluctuations in investor confidence, which is often mirrored in the stock price. Quarterly earnings releases have served as critical indicators of Intel’s operational effectiveness, revealing shifts in revenue and market share that are pivotal to understanding INTC stock movements.

Furthermore, external factors such as trade policies, supply chain disruptions due to global events, and technological advancements have all contributed to the variability in INTC stock performance. For example, recent global chip shortages have affected many semiconductor companies, including Intel, influencing their production capacities and market pricing strategies. The stock’s volatility can often be linked to these macroeconomic factors, alongside internal operational changes that shape investor perceptions.

Overall, the historical performance trends of INTC stock reveal an intricate interplay between the company’s strategic decisions and broader economic conditions. Investors analyzing these trends must consider both the internal and external factors that contribute to stock price movements, as these dynamics will continue to play a crucial role in determining the future trajectory of Intel’s stock in an increasingly competitive landscape.

Recent Developments Impacting Intel Stock

Intel Corporation (INTC) has witnessed notable developments that have significantly impacted its market performance and perception among investors. Recently, the company announced a series of new product launches aimed at enhancing its competitiveness against rival semiconductor firms. One of the most anticipated products is the upcoming release of its latest generation of processors, which promises to deliver improved performance and energy efficiency. These technological advancements are expected to renew investor confidence and potentially drive stock performance in the near term.

Additionally, Intel has been actively pursuing strategic partnerships to bolster its market position. Collaborations with leading firms in the technology sector aim to expand Intel’s reach in high-growth areas such as artificial intelligence and autonomous driving. These partnerships not only enhance Intel’s product portfolio but also position the company favorably within rapidly evolving technological landscapes. The market’s reaction to such alliances has been generally positive, reflecting an optimistic outlook on Intel’s capacity to innovate and capture new market share.

An equally important aspect of recent developments is the shift in management strategy under the leadership of CEO Pat Gelsinger. Since taking the helm, Gelsinger has emphasized a stringent focus on manufacturing capabilities and moving towards an open foundry model. This strategic pivot has garnered attention from industry analysts, who believe it could be a turning point for Intel. In response to these changes, analysts have adjusted their stock performance forecasts, indicating a cautious but hopeful stance on Intel’s future direction.

In summary, the combination of new product launches, strategic partnerships, and a redefined management approach has created a dynamic environment for Intel. These developments reflect the company’s commitment to overcoming challenges and enhancing its competitive edge, ultimately influencing the market’s perception of Intel stock moving forward.

Comparative Analysis: Intel vs. Nvidia

In the realm of semiconductor manufacturing, Intel (INTC) and Nvidia stand as two titans, each exhibiting distinctive product portfolios and strategies. Intel has historically dominated the market, primarily focusing on microprocessors for personal computers and servers. In recent years, however, the landscape has become increasingly challenging due to fierce competition from Nvidia, particularly in the graphics processing unit (GPU) space. Nvidia’s strength lies in its advanced GPU capabilities, which have made it a preferred choice for artificial intelligence (AI), machine learning, and gaming applications.

From a product offering perspective, Intel is in the process of diversifying its portfolio to include graphics solutions, while continuing to innovate within its traditional CPU base. The company has introduced products like the Intel Iris Xe graphics line, aiming to compete directly with Nvidia’s GPUs. Conversely, Nvidia has also ventured into the CPU market with its Arm-based architectures, indicating a strategic move to broaden its influence across a wider array of computing needs.

Examining market strategies, Intel has unveiled ambitious plans to reclaim its leadership position by ramping up investments in semiconductor manufacturing facilities, promoting its Intel Foundry Services. This initiative aims to capitalize on growing demand for chip production in the wake of supply chain disruptions. On the other hand, Nvidia has been adept at leveraging its graphic technology in the burgeoning fields of AI and data centers, showcasing innovations that have translated into robust revenue growth.

Financially, both companies present contrasting profiles. Intel has faced declining revenues and challenges in scaling its latest process technologies, impacting its stock performance. Nvidia, however, has benefitted from booming demand for its products, evidenced by skyrocketing revenues and a strong market capitalization. The competitive dynamics between Intel and Nvidia reflect not only their strategic choices but also their respective capabilities to adapt in an evolving market. Ultimately, these factors play a crucial role in shaping Intel’s stock outlook amidst rising competition from Nvidia.

Market Trends Affecting Semiconductor Stocks

The semiconductor industry plays a critical role in supporting various sectors, including consumer electronics, automotive, and telecommunications. Market trends significantly influence semiconductor stocks, reflecting both challenges and opportunities for companies such as Intel Corporation (INTC). One of the prevailing trends impacting this landscape is the ongoing supply chain disruptions that have plagued the industry since the COVID-19 pandemic. These issues have led to shortages of essential components, subsequently affecting production capacity and delivery timelines. As demand continues to outstrip supply, the ability of companies like Intel to navigate these challenges will be pivotal in determining stock performance.

Technological advancements also represent a significant trend within the semiconductor market. Innovations such as artificial intelligence (AI), 5G technology, and the growing adoption of electric vehicles have resulted in an increased demand for more sophisticated semiconductor solutions. Intel’s investment in research and development, particularly in manufacturing processes and emerging technologies, positions the company to capitalize on these advancements. Staying ahead of competitors in terms of technology will be vital for sustaining market share and improving profitability in an increasingly competitive environment.

Furthermore, shifts in consumer demand are reshaping the semiconductor industry. The transition to remote work, increased online services, and a heightened focus on smart technologies have driven a robust demand for semiconductors. This shift creates both opportunities and risks for companies like Intel, as they strive to adapt to evolving consumer needs while managing production and inventory. The company’s response to these consumer trends will likely play a crucial role in its future stock trajectory. By strategically aligning its product offerings with market demands, Intel could enhance its position within the competitive semiconductor arena.

Analyst Forecasts and Recommendations for INTC

Analysts play a crucial role in shaping investor perceptions of a stock’s potential, and their forecasts for Intel Corporation (INTC) reflect a mix of optimism and caution. The semiconductor industry has experienced notable volatility, driven by supply chain imbalances and the rapid evolution of technology. Analysts, therefore, offer varied insights into INTC’s future performance, particularly in the context of increased competition and changing consumer demands.

Many analysts maintain a cautiously optimistic outlook on INTC, recognizing its historical significance within the semiconductor market and recent strategic shifts. The consensus suggests potential growth driven by advancements in artificial intelligence (AI), Internet of Things (IoT) applications, and data center expansions. These areas are expected to bolster demand for Intel’s products, potentially leading to improved financial performance in the coming quarters. Price targets vary, with some analysts suggesting moderate upside potential, while others highlight the risks associated with the company’s ability to innovate and maintain market share.

Analyst ratings provide insights into the current sentiment among market experts, with a blend of ‘Buy,’ ‘Hold,’ and ‘Sell’ recommendations. The general trend leans towards a ‘Hold’ rating, signaling a wait-and-see approach as Intel navigates its competitive landscape. This sentiment often reflects concerns regarding the company’s ability to recover from production delays and effectively execute its turnaround strategies.

In light of these forecasts, investors and stakeholders should weigh the diverse perspectives offered by analysts. Understanding the rationale behind these recommendations can provide clarity as they consider Intel’s position in a rapidly evolving market and decide whether to invest or adopt a more cautious stance. By carefully analyzing these opinions, potential investors can align their strategies with the prevailing market dynamics.

Potential Risks and Challenges Ahead for Intel

As one of the leading players in the semiconductor industry, Intel Corporation (INTC) continues to navigate a complex landscape marked by various challenges and risks that could significantly affect its future performance. One of the major risks facing Intel is intense competition within the semiconductor sector. Companies such as AMD and NVIDIA have made substantial strides in developing advanced microprocessors and graphics cards, capturing significant market share. As these competitors continue to innovate and enhance their product offerings, Intel may find it increasingly difficult to maintain its competitive edge and pricing power.

Market volatility presents another substantial challenge for Intel. Fluctuations in demand for semiconductor products due to economic cycles can lead to significant revenue uncertainties. The global supply chain disruptions witnessed during recent years, exacerbated by geopolitical tensions and the ongoing effects of the COVID-19 pandemic, have highlighted Intel’s vulnerability to external shocks. These factors could potentially affect the company’s profit margins and, by extension, its stock price, which in turn impacts investor sentiment.

Regulatory issues also represent a notable risk. As governments worldwide continue to impose stricter regulations on technology companies, Intel may face increased scrutiny regarding data privacy, environmental impact, and fair competition practices. Non-compliance could result in costly penalties and reputational damage, further straining its market position.

Lastly, technological hurdles lie ahead for Intel as it strives to advance its semiconductor manufacturing processes to meet the demands of next-generation applications such as artificial intelligence and 5G technology. The failure to keep pace with technological advancements could hinder Intel’s growth potential and diminish its standing in the market.

Collectively, these risks underscore the importance for investors to remain vigilant, as they have the potential to disrupt Intel’s trajectory and influence its stock performance in the competitive landscape of the semiconductor industry.

Investment Considerations for Intel Stock

When evaluating Intel (INTC) as a potential investment, several key considerations should underpin the decision-making process. A thorough analysis begins with the assessment of the company’s financial performance, which encompasses revenue growth, profitability metrics, and recent earnings reports. Intel has faced strong competitive pressures from various industry players, which has affected its ability to maintain significant margins. However, recent strategic shifts indicate a focus on innovation and market penetration, suggesting potential for recovery and growth.

Additionally, investors should analyze the dividend yield as an important metric reflecting Intel’s commitment to returning capital to its shareholders. Historically, Intel has been known for consistent dividend payments, serving as an attractive feature for income-seeking investors. Understanding the sustainability of these dividends is crucial, especially in light of market volatility and the company’s commitment to reinvestment in technology. The current dividend yield should be compared against industry benchmarks to evaluate its competitiveness.

Valuation metrics such as the price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-book (P/B) ratio are also critical for assessing Intel’s stock. A comparative analysis against peers within the semiconductor sector aids in determining whether Intel is fairly valued or represents a buying opportunity. It is also beneficial to explore the company’s long-term growth strategies, including advancements in semiconductor technology, strategic partnerships, and geographic expansion plans, which could support future revenue growth and enhance market positioning.

In summary, potential investors in Intel stock should carefully evaluate the company’s financial performance, dividend yield, valuation metrics, and long-term growth strategies. A comprehensive understanding of these factors will facilitate informed investment decisions within the dynamic semiconductor landscape.

Conclusion: The Future of Intel and Its Stock Performance

As we reflect on the current state of Intel Corporation (INTC) within its competitive landscape, several key themes emerge regarding its stock performance and future prospects. The semiconductor industry is primarily influenced by rapid technological advancements, fluctuating market demands, and intense competition from both established players and new entrants. Intel’s ability to address these challenges will significantly impact its market position and stock valuation.

One of the critical factors for Intel moving forward is its commitment to innovation. The company has announced aggressive plans to ramp up its research and development efforts, focusing on enhancing its manufacturing capabilities and diversifying its product offerings. For instance, the recent investments in advanced process technologies demonstrate Intel’s intention to regain its technological leadership and better meet customer needs. By delivering high-quality, high-performance products, Intel can potentially secure its market share despite fierce competition.

Moreover, the growing demand for computing power driven by trends such as artificial intelligence, cloud computing, and the Internet of Things presents substantial opportunities for Intel. If the company can effectively leverage these trends, it may position itself favorably for long-term growth. However, it must also remain vigilant in managing potential risks associated with supply chain disruptions and geopolitical tensions, which could adversely affect its operations and profitability.

In conclusion, while Intel faces myriad challenges in a dynamic market, its proactive strategies and focus on technological advancement suggest a promising path ahead. The company’s dedication to innovation, combined with its strategic responses to market demands, may ultimately bolster investor confidence and enhance its stock performance in the coming years. Therefore, stakeholders should monitor Intel’s progress as it navigates this complex landscape, potentially yielding significant returns for those invested in its future.